do you have to pay taxes on inheritance money in wisconsin

In more simplistic terms only 2 out of 1000 Estates will owe Federal Estate Tax. If youve inherited an IRA you wont have to pay a penalty on early withdrawals if you take money out before age 59½.

Death Taxes Inheritances Reparations And The Disgraceful Duplicity Of The Right By Dave Buckner Phd The Polis Medium

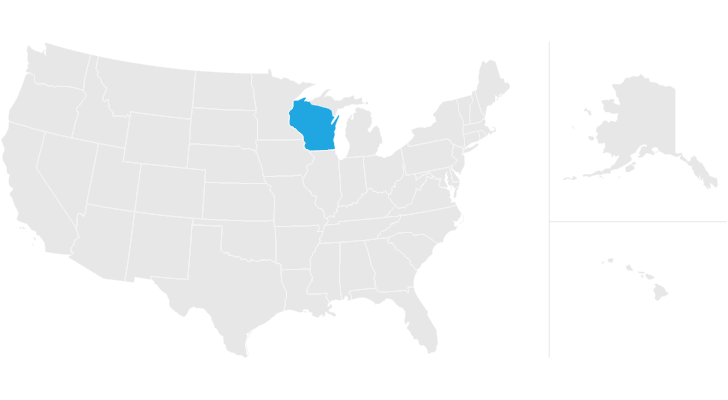

Wisconsin Inheritance and Gift Tax.

. For tax purposes an inheritance isnt normally considered taxable income unless its generating frequent returns such as a rental property or an asset that provides interest or dividend payments. There is no wisconsin inheritance tax for decedents dying on or after january 1 1992. What Does In Respect of a.

1 How much can you inherit without paying taxes. When you inherit property and sell it -- a house a car a Picasso -- you may have to pay tax. Doing so may trigger additional income taxes and even push you into a higher tax bracket.

Do You Have To Pay Taxes On An IRA Inheritance. These tax rates are based upon the relationship of the beneficiary to the deceased with no inheritance tax due from spouses and direct lineal descendants or ascendants ie. An inheritance tax is a tax on the property you receive from the decedent.

Twelve states and washington dc. Wisconsin does not levy an inheritance tax or an estate tax. Sale of Inherited Property.

The IRA has always been a complicated retirement account. This amount is called the estate tax exemption. Individual retirement accounts IRAs and inherited IRAs are tax-deferred accounts.

Even if you do end up owing some money in taxes on the sale of the home I hope you and your brother can still view this as a wonderful gift that your father has given you. Inheritance Tax While state inheritance taxes like estate taxes are normally paid by the estate representative or executor before estate assets are distributed to the beneficiaries the tax is. However as of 2021 only six states impose an inheritance tax.

However you may have to pay income tax if you inherit an IRAannuity etc which includes the decedents pre-tax dollars. At the time you receive the benefits youll have to pay any taxes that are payable. There are NO Wisconsin Inheritance Tax.

The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. Exempt Annuity Taxes For Inheritance Using pre-tax dollars qualifying annuities can help save money. Then you and your brother should discuss the best course of action with an accountant to determine which strategy would best reduce your tax bill.

You will also likely have to file some taxes on behalf of the deceased. If your fathers house was worth 170000 when you inherited it -- and the executor should be able to give you that information -- and if you sell it six months later for 190000 you have 20000 in taxable gains. For example if you inherit a traditional IRA or a 401k youll have to include all distributions you take out of the account in.

IRA distributions are treated as income and are subject to the. However you may have to make those withdrawals earlier than youd wanted. However if you are inheriting property from another state that state may have an estate tax that applies.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Wisconsin does not levy an inheritance tax or an estate tax. Upon your death you can transfer a certain amount of assets without paying any estate tax.

You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you inherit might come with some built-in income tax consequences. In Pennsylvania for instance the inheritance tax applies to all assets left by someone living in the state even if the inheritor is out-of-state. Is an inherited annuity taxed as ordinary income.

Wisconsin Gift Tax Return There is no Wisconsin gift tax for gifts made on or after January 1 1992. By The Money Farm Team. Wisconsin does not have a state inheritance or estate tax.

If you are a beneficiary you generally do not have to include inheritance on your income tax return. You should be notified by the estate if this is the case. However if the inheritance is considered income in respect of a decedent youll be subject to some taxes.

An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. The Federal estate tax only affects02 of Estates. Answer Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income.

Wisconsin also has no inheritance tax but there is a possibility youll owe an inheritance tax in another state if you inherit money or property from someone living in that state. However if you are inheriting property from another state that state may have an estate tax that applies. In general you do not owe income tax on cash you receive as an inheritancebut there is a caveat.

In 2017 the federal government set the estate tax exemption at 10 million as adjusted for inflation on an annual basis through 2025. An heirs inheritance will be subject to a state inheritance tax only if two conditions are met. You will also likely have to.

In 2021 the estate tax exemption amount is 117 million. Unlike the federal estate tax the beneficiary of the property is responsible for paying the tax not the estate. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms.

All inheritance are exempt in the State of Wisconsin. Since there are no wisconsin inheritance tax you do not need to file any tax forms. Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary.

When the owner of an IRA account or the beneficiary in the event of an inherited IRA account takes distributions tax is due. The state where you live is irrelevant. If you are a beneficiary you generally do not have to include inheritance on your income tax return.

Wisconsin Inheritance Tax Return There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. Do you have to pay taxes on inherited money in Wisconsin. It is possible to pay taxes on inherited annuity payments over the course of five years using the 5-year rule.

An inheritance tax is a state levy that americans pay when.

Is There A Federal Inheritance Tax Legalzoom Com

Inheritance Overview Distribution And Restrictions

State Estate And Inheritance Taxes Itep

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Wisconsin Estate Tax Everything You Need To Know Smartasset

Probate High Resolution Stock Photography And Images Alamy

Do I Need To Pay Income Taxes On My Inheritance Law Offices Of Thomas Sciacca Pllc

Tax Consequences When Selling A House I Inherited In Massachusetts Pavel Buys Houses

Is Your Inheritance Considered Taxable Income H R Block

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do I Pay Taxes On Inheritance Of Savings Account

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Wisconsin Estate Tax Everything You Need To Know Smartasset

5 Ways The Rich Can Avoid The Estate Tax Smartasset

What To Do And Not Do With An Inheritance

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

What Is Inheritance Tax Who Pays How Much Sydney Wills Lawyer

States With No Estate Tax Or Inheritance Tax Plan Where You Die